Hey there, finance enthusiasts! Are you tired of feeling lost when it comes to managing your Chase checkbook? Well, you're not alone. Many people struggle with understanding the ins and outs of their bank accounts, especially when it comes to using checks. But don't worry, we've got you covered. In this article, we'll dive deep into everything you need to know about your Chase checkbook and how to make the most out of it.

Managing your finances can be overwhelming, but having a solid understanding of your Chase checkbook is a game-changer. Whether you're writing your first check or just want to brush up on your skills, this guide will walk you through the basics and beyond. So grab a cup of coffee, sit back, and let's get started!

Before we dive into the nitty-gritty details, let's talk about why your Chase checkbook is such a powerful tool. It's more than just a piece of paper; it's a way to take control of your financial life. By the end of this article, you'll be equipped with the knowledge to manage your finances like a pro and avoid common pitfalls. Ready to rock your Chase checkbook game? Let's go!

Read also:Buddy Epson Your Ultimate Guide To A Trustworthy Companion In The Digital Age

What is a Chase Checkbook Anyway?

Alright, let's start with the basics. A Chase checkbook is essentially a booklet of checks provided by Chase Bank. These checks allow you to make payments directly from your checking account without needing cash or cards. It's like having a little financial wizard in your pocket. Each check contains essential details such as your account number, routing number, and signature line.

But here's the kicker—using a checkbook is more than just writing numbers on a piece of paper. It requires a bit of strategy and planning to ensure everything runs smoothly. Think of your Chase checkbook as your personal finance assistant, helping you keep track of transactions and manage your money effectively.

Why Chase Checkbooks Still Matter in 2023

With the rise of digital payments, some people might wonder why checkbooks are still relevant. Well, let me tell you, they're not going anywhere anytime soon. Here are a few reasons why Chase checkbooks are still a valuable tool in today's world:

- Convenience: Checks can be used for payments where digital options aren't available, like paying landlords or small businesses.

- Security: Unlike cash, checks provide a paper trail, making it easier to track your expenses.

- Versatility: Whether you're paying bills or gifting money, checks offer flexibility in various financial situations.

So, even in this digital age, having a Chase checkbook in your arsenal can be a huge advantage. It's like carrying a Swiss Army knife for your finances—always useful in unexpected situations.

How to Order a Chase Checkbook

Now that you know the importance of a Chase checkbook, let's talk about how to get your hands on one. Ordering a Chase checkbook is a straightforward process, but there are a few steps you need to follow:

First things first, log in to your Chase account online or visit your local Chase branch. If you're doing it online, head over to the "Order Checks" section and select the type of checkbook you want. Chase offers a variety of options, including personalized checks and duplicate checks, so choose what works best for you.

Read also:Top Tv Shows Featuring The Talented Paty Navidad

Once you've placed your order, sit back and relax. Your Chase checkbook will usually arrive within 7-10 business days. Pro tip: Always double-check your address to avoid any delays in delivery. And if you're impatient like me, you can always call Chase customer service to track your order.

Tips for Customizing Your Chase Checkbook

Who says checkbooks can't be stylish? When ordering your Chase checkbook, you can personalize it with your name, address, and even a cool design. Here are a few tips to make your checkbook stand out:

- Add a Signature Line: This ensures that only you can authorize payments, adding an extra layer of security.

- Choose a Unique Design: Chase offers a variety of designs, from classic to modern, so pick one that reflects your personality.

- Consider Duplicate Checks: If you want to keep a record of every check you write, opt for duplicate checks. It's like having a built-in receipt system.

Customizing your Chase checkbook not only makes it more personal but also helps you stay organized and secure. Plus, who doesn't love a little flair in their finances?

Understanding the Components of a Chase Check

Now that you've got your Chase checkbook, it's time to break down its components. Each check is packed with important information that you need to understand before using it. Here's what you'll find on a typical Chase check:

- Check Number: This unique identifier helps you keep track of each check you write.

- Date: Always write the current date to ensure the check is valid.

- Payee: The name of the person or business receiving the payment.

- Amount: Write the payment amount in both numbers and words to avoid confusion.

- Signature: Your signature is what makes the check official, so don't forget it!

Understanding these components will help you avoid mistakes and ensure your checks are processed smoothly. It's like learning the rules of the road before you hit the highway—essential for a safe and successful journey.

Common Mistakes to Avoid When Writing a Chase Check

Even the best of us make mistakes when writing checks. But don't worry, I've got a list of common errors to watch out for:

- Skipping the Date: Always write the correct date to avoid delays or rejections.

- Forgetting to Sign: An unsigned check is like a car without fuel—useless!

- Writing Illegibly: Keep your handwriting neat and clear to prevent misunderstandings.

By avoiding these pitfalls, you'll ensure your Chase checks are processed without any hiccups. It's like giving your finances a little boost of confidence, knowing you've got everything under control.

Tracking Your Chase Checkbook Transactions

One of the most important aspects of managing your Chase checkbook is keeping track of your transactions. This not only helps you stay organized but also allows you to monitor your account activity for any discrepancies. Here's how you can track your Chase checkbook transactions:

First, use your Chase app or online banking platform to view your recent transactions. You can also keep a physical check register to record each check you write. This register should include the check number, date, payee, and amount. It's like having a mini financial diary that keeps you in the loop.

Pro tip: Reconcile your checkbook regularly with your bank statements. This will help you catch any errors or unauthorized transactions early on. Think of it as a financial health check-up—essential for maintaining a strong financial foundation.

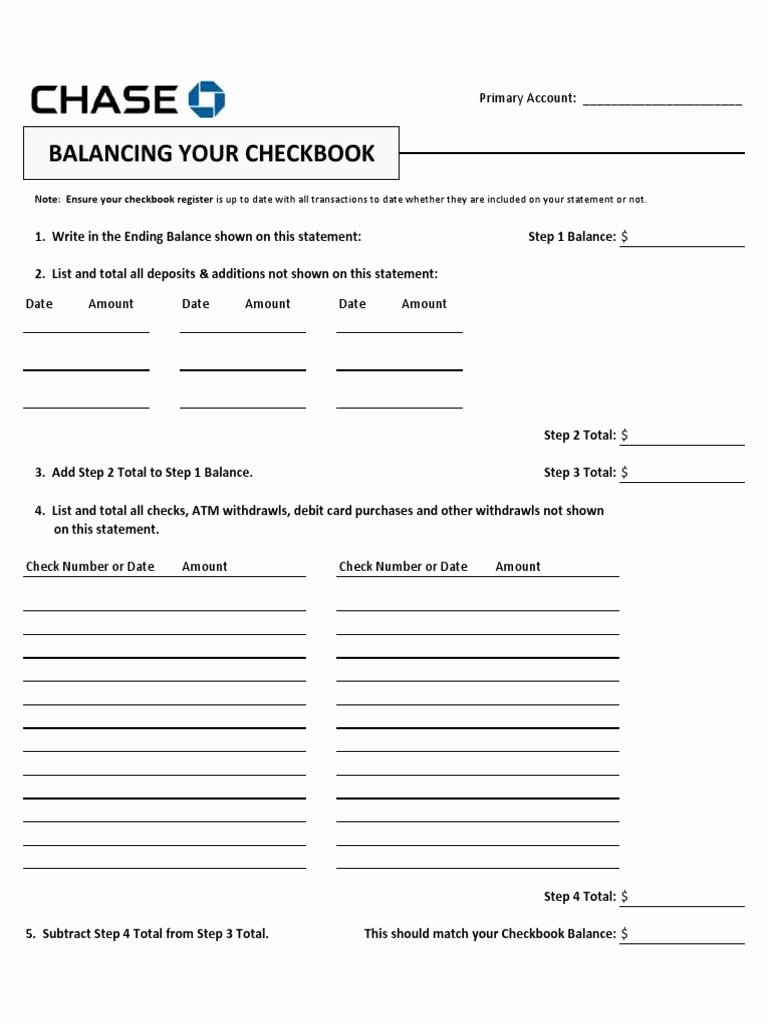

The Importance of Reconciliation

Reconciliation might sound like a fancy word, but it's simply the process of comparing your checkbook records with your bank statements. Here's why it matters:

- Error Detection: Catch any mistakes or discrepancies before they become bigger issues.

- Account Balance Accuracy: Ensure your account balance reflects your actual financial situation.

- Peace of Mind: Knowing your finances are in order gives you a sense of security and control.

By making reconciliation a regular part of your financial routine, you'll be better equipped to manage your Chase checkbook and avoid any surprises down the road.

Security Tips for Your Chase Checkbook

When it comes to your Chase checkbook, security should always be a top priority. Here are a few tips to keep your checks safe and protect your financial information:

- Store Your Checkbook Securely: Keep it in a locked drawer or safe place to prevent unauthorized access.

- Monitor Your Account: Regularly check your account for any suspicious activity and report it immediately.

- Shred Unused Checks: If you have old or unused checks, shred them to prevent identity theft.

By following these security tips, you'll ensure your Chase checkbook remains a trusted tool in your financial arsenal. It's like putting a security guard on duty to watch over your finances 24/7.

What to Do If Your Chase Checkbook is Lost or Stolen

Oh no, your Chase checkbook is missing! Don't panic—here's what you need to do:

- Contact Chase Immediately: Call Chase customer service to report the loss and have your account monitored for suspicious activity.

- Freeze Your Account: If necessary, temporarily freeze your account to prevent unauthorized transactions.

- Order a New Checkbook: Once the situation is resolved, order a new checkbook to keep your financial operations running smoothly.

Acting quickly can save you a lot of headaches and potential financial losses. Remember, your Chase checkbook is a powerful tool, and keeping it secure is key to maintaining your financial well-being.

Conclusion: Mastering Your Chase Checkbook

And there you have it, folks! A comprehensive guide to mastering your Chase checkbook. From understanding the basics to implementing security measures, you're now equipped with the knowledge to take control of your finances like a pro.

Remember, your Chase checkbook is more than just a tool—it's a partner in your financial journey. By using it wisely and staying organized, you'll be well on your way to achieving financial success. So go ahead, write those checks with confidence and make your money work for you.

Before you go, I'd love to hear your thoughts. Do you have any tips or tricks for managing a Chase checkbook? Leave a comment below and let's keep the conversation going. And don't forget to share this article with your friends and family—it might just help them become checkbook wizards too!

Table of Contents

- What is a Chase Checkbook Anyway?

- Why Chase Checkbooks Still Matter in 2023

- How to Order a Chase Checkbook

- Tips for Customizing Your Chase Checkbook

- Understanding the Components of a Chase Check

- Common Mistakes to Avoid When Writing a Chase Check

- Tracking Your Chase Checkbook Transactions

- The Importance of Reconciliation

- Security Tips for Your Chase Checkbook

- What to Do If Your Chase Checkbook is Lost or Stolen