Hey there, friend! If you're diving into the world of banking, you've probably heard about Chase checks. Whether you're just starting out with Chase or you're a seasoned account holder looking to optimize your finances, understanding how Chase checks work is crucial. In this guide, we'll break down everything you need to know about Chase checks, including how to use them, common issues, and tips to make your banking experience smoother.

Let's be real—checks might seem like an old-school way to pay, but they're still super relevant for certain situations. From paying rent to sending money to family, Chase checks can help you manage your finances efficiently. Plus, knowing how they work can save you from potential headaches down the line.

This article is packed with actionable insights, tips, and tricks to help you master Chase checks. Stick around, and by the end, you'll feel like a pro!

Read also:What Size Is A 9 Inch Pizza A Deep Dive Into Pizza Perfection

Table of Contents

- What Are Chase Checks?

- How to Order Chase Checks

- Using Chase Checks: The Basics

- Types of Chase Checks

- Chase Checks Fees: What You Need to Know

- Avoiding Common Mistakes with Chase Checks

- Security Tips for Chase Checks

- Frequently Asked Questions

- Chase Checks in the Digital Age

- Conclusion

What Are Chase Checks?

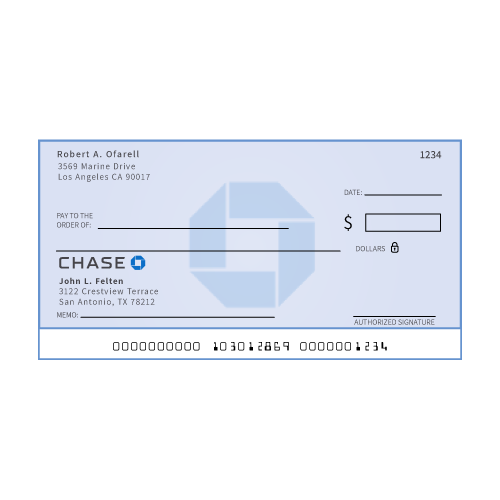

Alright, let's start with the basics. Chase checks are official checks issued by JPMorgan Chase, one of the largest banks in the U.S. These checks come in handy when you need to make a payment that requires a secure, traceable method. Whether you're paying for a big-ticket item or transferring funds to someone who prefers checks, Chase checks have got you covered.

Chase checks are different from regular personal checks because they're drawn directly from your account balance. This means the bank guarantees the payment, making them more reliable for recipients. It's like having a little extra peace of mind when you're making important payments.

Why Choose Chase Checks?

- Guaranteed payment from the bank

- Secure and traceable transactions

- Convenient for large or important payments

How to Order Chase Checks

Ordering Chase checks is easier than you think. You can do it online, through the Chase app, or by visiting a local branch. Here's a quick rundown of the steps:

Step 1: Log in to your Chase account online or open the Chase app.

Step 2: Navigate to the "Order Checks" section. This is usually under the "Settings" or "Account Services" tab.

Step 3: Choose the type of checks you want (personal, business, etc.) and customize them with your info.

Read also:Vanessa Marcil The Journey Of A Hollywood Icon

Step 4: Confirm your order and wait for your checks to arrive in the mail.

Pro tip: If you're ordering checks for the first time, consider adding a security feature like a watermark to prevent fraud.

Using Chase Checks: The Basics

Now that you have your Chase checks, it's time to put them to use. Here's how it works:

- Fill in the date, payee's name, and the amount you want to pay.

- Sign the check on the designated line.

- Write a memo (optional) to remind yourself what the check is for.

- Hand over the check to the recipient or mail it if needed.

Remember, always double-check the details before signing. Mistakes on checks can lead to delays or even rejection.

What Happens After You Send a Chase Check?

Once the recipient receives your check, they can deposit or cash it at their bank. The funds will be deducted from your account once the check clears. Chase usually processes checks within a few business days, but this can vary depending on the recipient's bank.

Types of Chase Checks

Not all Chase checks are created equal. Depending on your needs, you might opt for one of these:

Personal Checks

Perfect for everyday use, personal checks let you pay bills, rent, or gifts. They're customizable and come with your info pre-printed.

Certified Checks

Certified checks are guaranteed by Chase, making them ideal for large transactions like buying a car or paying off a loan.

Money Orders

Money orders are similar to checks but don't require a bank account. They're a great option if you don't have a Chase account but still need a secure payment method.

No matter which type you choose, Chase checks offer flexibility and security for all your payment needs.

Chase Checks Fees: What You Need to Know

Let's talk about the elephant in the room—fees. Chase doesn't charge for personal checks, but there might be fees for certified checks or money orders. Here's a breakdown:

- Personal checks: Free with most Chase accounts

- Certified checks: Around $8 per check

- Money orders: Approximately $10 per money order

Check with your local branch or online for the most up-to-date fee info. Some accounts might offer fee waivers or discounts, so it's worth asking.

How to Avoid Extra Fees

One way to save on fees is to stick with personal checks for routine payments. For larger transactions, consider using online banking or wire transfers if available. And hey, who doesn't love saving a buck or two?

Avoiding Common Mistakes with Chase Checks

Mistakes happen, but when it comes to Chase checks, they can cost you time and money. Here are a few common slip-ups to avoid:

- Forgetting to sign the check

- Writing the wrong amount or payee name

- Not keeping track of your checkbook balance

Pro tip: Always keep a record of your checks in your checkbook register. This helps you stay on top of your finances and avoid overdraft fees.

Security Tips for Chase Checks

In today's digital world, security is key. Here are some tips to keep your Chase checks safe:

- Store your checks in a secure place at home

- Use checks with security features like watermarks

- Report lost or stolen checks immediately to Chase

By taking these precautions, you can protect yourself from fraud and unauthorized transactions.

Frequently Asked Questions

Got questions? We've got answers. Here are some FAQs about Chase checks:

Can I Cancel a Chase Check?

Yes, you can cancel a Chase check, but it might cost you a fee. Contact Chase customer service for assistance.

How Long Does It Take for a Chase Check to Clear?

Chase checks typically clear within 1-3 business days, depending on the recipient's bank.

What Happens If I Overdraft with a Chase Check?

If your account doesn't have enough funds to cover a check, it might bounce, or Chase could cover it for a fee. To avoid this, always check your balance before writing a check.

Chase Checks in the Digital Age

While checks might seem outdated in a world of digital payments, they still hold their ground. Chase continues to innovate by offering features like mobile check deposit and digital check imaging. These tools make managing checks easier and more convenient than ever.

Even with the rise of mobile banking, Chase checks remain a reliable option for secure payments. They're especially useful for transactions where digital methods aren't feasible or preferred.

Conclusion

And there you have it—a comprehensive guide to Chase checks. From ordering to using and securing your checks, we've covered everything you need to know. Remember, Chase checks are a powerful tool for managing your finances, but they require a bit of care and attention.

So, whether you're writing your first check or you're a seasoned pro, always keep these tips in mind. And don't forget to share this article with your friends who might find it useful. Together, let's make banking easier and more secure for everyone!

What are your thoughts on Chase checks? Let us know in the comments below, and feel free to ask any questions you might have. We're here to help!