Let’s face it, folks—there’s nothing worse than running out of checks when you need them most. Whether you’re paying your rent, sending money to family, or handling business expenses, having a checkbook is still essential for many of us. If you’re a Chase customer and wondering how to order a checkbook Chase-style, you’re in the right place. In this guide, we’ll break it down step by step so you can get your hands on those checks without breaking a sweat.

But wait—why do we even need checks in 2023? With all the digital payment options out there, checks might seem old-school, but they’re far from obsolete. They’re still a secure, reliable way to transfer funds, especially for large payments or formal transactions. And if you’re a Chase customer, ordering a checkbook is easier than you think.

Now, before we dive into the nitty-gritty, let’s set the stage. Ordering a checkbook Chase-style isn’t just about clicking a button. It’s about understanding your options, knowing what to expect, and making sure everything runs smoothly. So, buckle up, because we’re about to walk you through the entire process—from start to finish.

Read also:Julian Edelman Family A Closer Look At The Nfl Stars Personal Life

Understanding the Basics of Chase Checkbooks

First things first, let’s talk about what a Chase checkbook actually is. A checkbook is a booklet of pre-printed checks linked to your Chase checking account. When you write a check, you’re essentially giving someone a written promise to pay a specific amount of money from your account. Simple, right? But here’s the thing—Chase offers different types of checkbooks, and knowing which one suits your needs is key.

For example, Chase provides standard checkbooks, personalized checks, and even expedited options if you’re in a rush. The best part? You can customize your checks with your name, address, and even a special message if you want to get fancy. It’s all about tailoring the experience to fit your lifestyle.

Why Choose Chase for Your Checkbook Needs?

Here’s the deal: Chase is one of the biggest banks in the U.S., and they’ve been in the game for a long time. That means they’ve got the systems and resources to make ordering a checkbook a breeze. Plus, Chase offers perks like fraud protection, secure printing, and easy online ordering. If you’re already a Chase customer, sticking with them for your checkbook needs makes perfect sense.

But don’t just take our word for it. According to a recent survey by the Federal Reserve, checks are still one of the most trusted payment methods in the U.S., with over 17 billion checks processed annually. That’s a lot of trust, folks!

How to Order a Checkbook Chase: Step-by-Step Guide

Alright, let’s get down to business. Ordering a checkbook Chase-style is simpler than you might think. Follow these steps, and you’ll have your checks in no time:

- Log in to Your Chase Account: Head over to the Chase website or open the Chase mobile app. Make sure you’re logged in to your account.

- Locate the Check Ordering Section: Once you’re in, navigate to the “Order Checks” section. It’s usually found under the “Accounts” or “Services” tab.

- Choose Your Checkbook Type: Decide whether you want a standard checkbook, personalized checks, or expedited delivery. Each option has its own benefits, so take a moment to consider what works best for you.

- Customize Your Checks: Add your name, address, and any other details you want to include. You can even choose the design and layout of your checks.

- Review and Confirm: Double-check everything before you hit the “Order” button. Mistakes happen, so it’s always a good idea to review your order carefully.

And that’s it! Your checkbook will be on its way, usually arriving within 7-10 business days. If you opt for expedited delivery, you might get it even faster.

Read also:Times Health Mag Blog Your Ultimate Guide To Health And Wellness

What Happens After You Order?

Once you’ve placed your order, Chase takes care of the rest. They’ll send your checkbook to the printer, who will then mail it directly to your address. Keep an eye on your email, as Chase often sends updates about the status of your order. If something goes wrong—like a delay or a missing checkbook—Chase’s customer service team is there to help.

Common Questions About Ordering a Checkbook Chase

Let’s tackle some of the most common questions people have when ordering a checkbook Chase-style:

How Much Does It Cost?

Good news, folks—Chase doesn’t charge a fee for ordering a checkbook. However, the printer might charge a small fee depending on the type of checks you order. Standard checkbooks usually cost around $15-$25, while personalized checks can be a bit pricier.

Can I Track My Order?

Absolutely! After you place your order, Chase will provide you with a tracking number. You can use this number to keep tabs on where your checkbook is and when it’s expected to arrive.

What If I Lose My Checkbook?

Losing a checkbook can be stressful, but don’t panic. Chase has a process in place to help you cancel your lost checkbook and order a new one. Simply call their customer service hotline, and they’ll guide you through the steps to secure your account.

Tips for Managing Your Chase Checkbook

Now that you know how to order a checkbook Chase-style, let’s talk about how to manage it effectively:

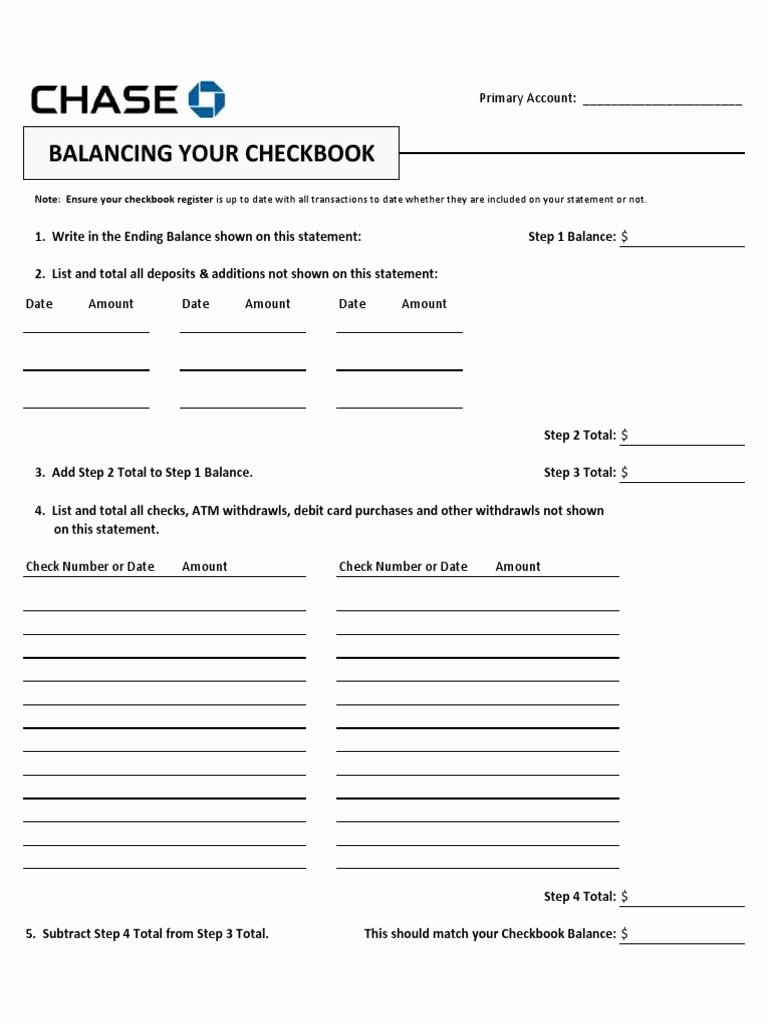

- Keep Track of Your Checks: Use a check register or app to log every check you write. This helps you avoid overdraft fees and keeps your finances in check.

- Store Your Checkbook Safely: Don’t leave your checkbook lying around. Keep it in a secure location, especially if you live with roommates or family members.

- Review Your Statements Regularly: Make it a habit to review your bank statements every month. This way, you can catch any discrepancies or unauthorized transactions early on.

These tips might seem simple, but they can save you a lot of headaches in the long run. Managing your checkbook responsibly is all about staying organized and being proactive.

Security Measures to Protect Your Checks

Security is a big deal when it comes to checks. Chase takes several measures to ensure your checks are safe, including:

- Using secure printers with anti-fraud technology.

- Embedding watermarks and security features in the checks themselves.

- Offering tools to monitor your account for suspicious activity.

By combining these measures with your own vigilance, you can keep your checks safe and sound.

Alternatives to Chase Checkbooks

While Chase is a great option for ordering checkbooks, it’s not the only game in town. If you’re looking for alternatives, here are a few worth considering:

Other Banks and Credit Unions

Many other banks and credit unions offer checkbook ordering services similar to Chase. For example, Bank of America, Wells Fargo, and local credit unions often provide their own checkbook ordering platforms. The key is to compare fees, delivery times, and customization options to find the best fit for your needs.

Third-Party Check Printers

If you’re not tied to Chase, you can also order checks from third-party printers like Checks Unlimited or Deluxe. These companies offer a wide range of options, from basic checks to premium designs. Just be sure to verify their security measures before placing an order.

The Future of Checks: Are They Here to Stay?

As we mentioned earlier, checks might seem old-school, but they’re still relevant in today’s digital world. According to a report by JPMorgan Chase, checks remain a preferred payment method for certain transactions, such as rent payments, business expenses, and large purchases. In fact, the demand for checks is expected to remain steady for the foreseeable future.

That said, the banking industry is constantly evolving. With advancements in mobile banking, digital payments, and blockchain technology, it’s possible that checks could become less common over time. But until then, having a reliable checkbook is still a smart move.

How Chase is Adapting to the Changing Landscape

Chase is no stranger to innovation. They’ve been investing heavily in digital solutions to make banking easier and more convenient for their customers. For example, Chase offers mobile check deposit, online bill pay, and even virtual cards for secure transactions. These tools complement traditional checkbooks, giving customers more flexibility in how they manage their finances.

Final Thoughts: Why Chase Checkbooks Matter

Ordering a checkbook Chase-style is more than just a transaction—it’s about securing your financial future. Whether you’re a student, a small business owner, or a retiree, having access to reliable checks can make a big difference in your day-to-day life. Chase makes the process easy, secure, and customizable, so you can focus on what really matters.

So, what’s the next step? If you’re running low on checks, don’t wait—order your Chase checkbook today. And while you’re at it, take a moment to explore Chase’s other services and features. Who knows? You might discover something that takes your banking experience to the next level.

Don’t forget to share this article with your friends and family, and leave a comment below if you have any questions or feedback. We’d love to hear from you!

Table of Contents

- Understanding the Basics of Chase Checkbooks

- Why Choose Chase for Your Checkbook Needs?

- How to Order a Checkbook Chase: Step-by-Step Guide

- Common Questions About Ordering a Checkbook Chase

- Tips for Managing Your Chase Checkbook

- Security Measures to Protect Your Checks

- Alternatives to Chase Checkbooks

- The Future of Checks: Are They Here to Stay?

- Final Thoughts: Why Chase Checkbooks Matter