Welcome to paradise! The cost of living in Hawaii is more than just numbers—it’s a lifestyle choice. Picture this: pristine beaches, lush rainforests, and sunsets that’ll make you question reality. But before you pack your bags and chase the Aloha Spirit, there’s one big question to tackle—how much does it cost to live in Hawaii? Spoiler alert: it’s not exactly cheap. So, grab your favorite drink, and let’s dive into the nitty-gritty details of what it takes to thrive in paradise.

When most people think about Hawaii, they imagine luaus, hula dances, and sipping Mai Tais under palm trees. And while all of that is real, there’s also the reality of paying the bills. From groceries to rent, Hawaii has a reputation for being one of the most expensive places to live in the U.S. But don’t panic just yet! We’re here to break it down step by step so you can decide if this tropical dream is worth the investment.

Before we dive into the numbers, let’s set the scene. Hawaii isn’t just one island—it’s a chain of eight major islands, each with its own vibe. From bustling Honolulu on Oahu to the laid-back charm of Maui and the Big Island, the cost of living can vary depending on where you choose to plant your roots. Ready? Let’s get started!

Read also:Vanessa Marcil The Journey Of A Hollywood Icon

Daftar Isi

- Overview: What You Need to Know

- Housing Costs: Renting or Buying?

- Groceries: Feeding Your Wallet and Your Stomach

- Transportation: Getting Around the Islands

- Utilities: Powering Your Paradise

- Healthcare: Staying Healthy in Hawaii

- Entertainment: Living the Aloha Life

- Taxes: Paying Your Share

- Income: Making Ends Meet

- Tips for Saving Money in Hawaii

Overview: What You Need to Know

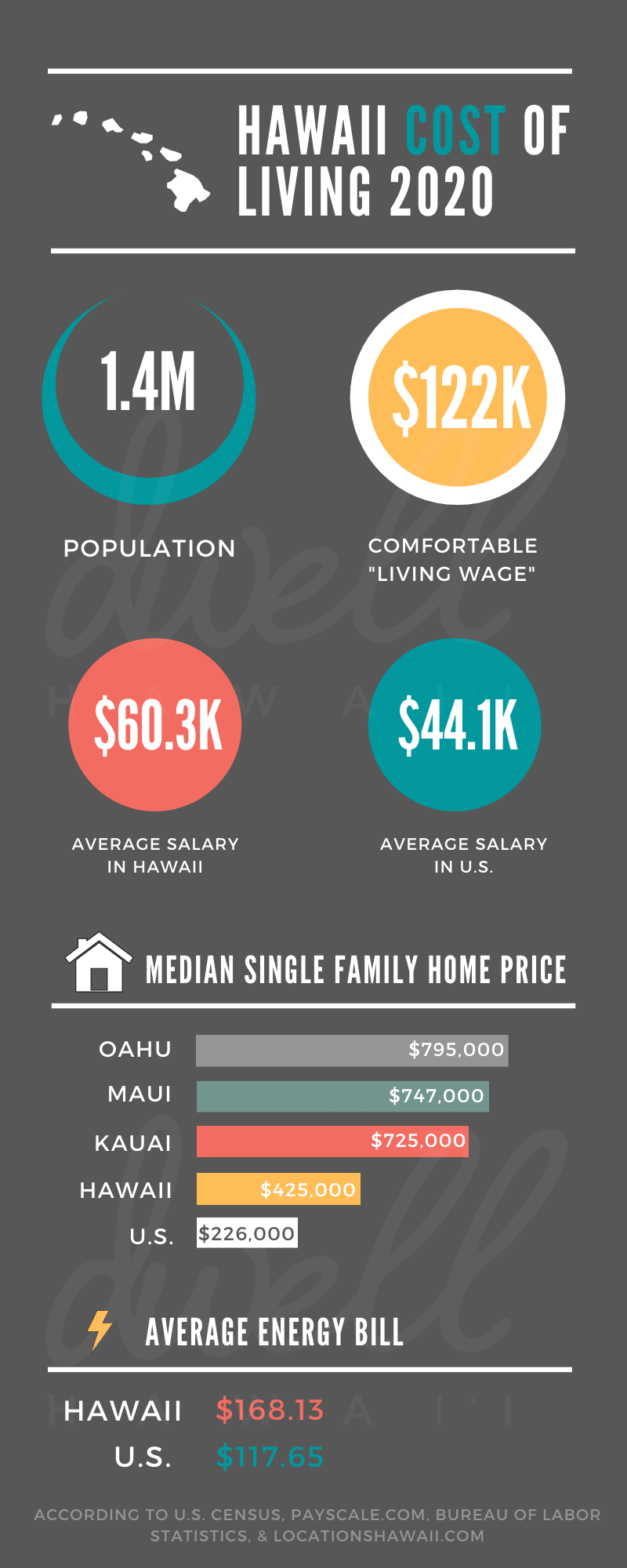

Let’s start with the big picture. The cost of living in Hawaii is significantly higher than the national average. According to a report by the Bureau of Labor Statistics, Hawaii ranks as one of the most expensive states in the U.S. when it comes to housing, food, and utilities. But why is it so pricey? Well, for starters, everything has to be shipped in from the mainland, which drives up costs. Plus, the demand for housing far outweighs the supply, especially in popular areas like Honolulu.

Key Factors Affecting the Cost of Living

There are several factors that contribute to the high cost of living in Hawaii:

- Transportation costs: Everything you buy, from groceries to furniture, has to be shipped in.

- Real estate prices: Limited land and high demand make housing expensive.

- Tourism: The influx of tourists drives up prices for everything from hotels to restaurants.

- Energy costs: Hawaii relies heavily on imported oil for electricity, which makes utility bills higher.

But don’t let the numbers scare you! Living in Hawaii is an experience like no other. The trade-off for the higher cost of living is access to some of the most beautiful natural landscapes in the world, a vibrant cultural scene, and a slower pace of life.

Housing Costs: Renting or Buying?

When it comes to housing, Hawaii is no joke. The median home price in 2023 was a staggering $850,000, with prices in popular areas like Honolulu reaching well over $1 million. If buying isn’t in your budget, renting might seem like a more feasible option—but even that comes with a hefty price tag. The average rent for a one-bedroom apartment in Honolulu is around $2,500 per month.

Where to Live in Hawaii

Location plays a big role in how much you’ll pay for housing. Here’s a breakdown of the major islands and their housing costs:

- Oahu: The most expensive island, with median home prices over $1 million in Honolulu.

- Maui: A bit more affordable than Oahu, but still pricey, with median home prices around $700,000.

- Kauai: Known as the Garden Island, Kauai offers a more laid-back lifestyle and slightly lower prices, with median home prices around $600,000.

- Big Island: The largest island offers the most affordable housing options, with median home prices around $500,000.

So, what’s the takeaway? If you’re looking to save money, consider moving to less touristy areas or smaller towns. And if you’re serious about buying, start saving early!

Read also:Temporary Replacement Hyungru The Rising Star In The Spotlight

Groceries: Feeding Your Wallet and Your Stomach

Grocery shopping in Hawaii can feel like a rollercoaster ride for your wallet. With most food items being shipped in from the mainland, prices tend to be higher than in other parts of the country. The average family spends around $10,000 per year on groceries, which is about 30% more than the national average.

How to Save on Groceries

But don’t worry, there are ways to stretch your grocery budget in Hawaii:

- Shop at local farmers’ markets for fresh produce at lower prices.

- Buy in bulk at warehouse stores like Costco or Sam’s Club.

- Take advantage of sales and discounts at grocery stores like Safeway and Foodland.

- Grow your own fruits and vegetables if you have the space.

And let’s not forget about the amazing local cuisine! From poke bowls to kalua pig, Hawaii offers a unique food culture that’s worth exploring. Just be prepared to pay a premium for imported items like dairy and meat.

Transportation: Getting Around the Islands

Transportation is another big expense to consider when living in Hawaii. While the islands are relatively small, getting around can still be costly. Public transportation is limited, especially outside of Honolulu, so owning a car is almost a necessity. Gas prices are among the highest in the country, averaging around $4.50 per gallon in 2023.

Alternative Transportation Options

If owning a car isn’t in your budget, here are some alternatives:

- Public Transit: TheBus is the main public transportation system on Oahu, with fares starting at $2.50.

- Biking: Many areas are bike-friendly, and renting a bike can be a fun and affordable way to get around.

- Car-Sharing: Services like Zipcar offer pay-as-you-go car rentals for short trips.

And let’s not forget about the stunning scenery you’ll enjoy along the way! Whether you’re driving along the Hana Highway or biking through the countryside, the journey is half the fun.

Utilities: Powering Your Paradise

Utilities in Hawaii can be a real drain on your wallet. With the state relying heavily on imported oil for electricity, energy costs are among the highest in the country. The average monthly utility bill for a two-bedroom apartment is around $200, but this can vary depending on your location and usage.

How to Save on Utilities

Here are a few tips to help keep your utility bills in check:

- Invest in energy-efficient appliances and lighting.

- Use fans instead of air conditioning when possible.

- Take advantage of solar power if you own your home.

- Turn off lights and electronics when not in use.

And don’t forget about the natural elements! Hawaii’s mild climate means you won’t need to use heating or air conditioning as much as in other parts of the country.

Healthcare: Staying Healthy in Hawaii

Healthcare costs in Hawaii are relatively high, but the state also has a unique system in place to help residents afford coverage. The Hawaii Prepaid Health Care Act requires employers to provide health insurance to employees who work more than 20 hours per week. This has resulted in one of the highest rates of insured residents in the country.

Healthcare Costs in Hawaii

Here’s a breakdown of healthcare costs in Hawaii:

- Monthly premiums: Average around $500 for individual plans and $1,500 for family plans.

- Doctor visits: Co-pays range from $20 to $50 depending on your plan.

- Prescriptions: Average co-pays are around $10 to $30.

And let’s not forget about the importance of staying active! Hawaii offers endless opportunities for outdoor activities like hiking, surfing, and yoga, which can help keep you healthy and reduce healthcare costs in the long run.

Entertainment: Living the Aloha Life

When it comes to entertainment, Hawaii has no shortage of options. From cultural festivals to outdoor adventures, there’s always something to do. And the best part? Many activities are free or low-cost, thanks to the abundance of natural beauty and community events.

Top Free Activities in Hawaii

Here are some ideas for affordable entertainment in Hawaii:

- Hike to a waterfall or lookout point.

- Explore local beaches and parks.

- Attend free cultural events and festivals.

- Visit museums and art galleries with free admission days.

And if you’re feeling adventurous, why not try something new? Surfing lessons, snorkeling, and paddleboarding are all great ways to experience the islands up close.

Taxes: Paying Your Share

Taxes in Hawaii are a bit different from the mainland. The state has no sales tax, but instead, charges a General Excise Tax (GET) on most goods and services. The GET ranges from 4% to 4.712%, depending on the location. Property taxes are relatively low compared to other states, but income taxes are higher than average.

Income Tax Brackets in Hawaii

Here’s a look at the income tax brackets in Hawaii:

- $0 - $2,400: 1.4%

- $2,401 - $4,800: 3.0%

- $4,801 - $9,600: 4.4%

- $9,601 - $12,000: 6.4%

- Over $12,000: 8.25%

And let’s not forget about the state’s generous tax incentives for renewable energy and sustainable living. If you’re thinking about installing solar panels or going green, there are plenty of programs to help offset the costs.

Income: Making Ends Meet

With the high cost of living in Hawaii, it’s important to have a steady income. The median household income in Hawaii is around $83,000, which is higher than the national average. But with housing and other expenses being so high, it can still be a challenge to make ends meet.

Top Industries in Hawaii

Here are some of the top industries in Hawaii:

- Tourism: The backbone of Hawaii’s economy, with millions of visitors each year.

- Government: A major employer, with jobs ranging from military to public service.

- Healthcare: A growing sector, thanks to Hawaii’s aging population.

- Technology: An emerging industry, with a focus on innovation and sustainability.

And let’s not forget about the entrepreneurial spirit! Many residents start their own businesses, from food trucks to eco-tours, taking advantage of Hawaii’s unique market.

Tips for Saving Money in Hawaii

Living in Hawaii doesn’t have to break the bank. Here are some tips for saving money while still enjoying the Aloha lifestyle:

- Live outside of tourist areas for lower housing costs.