When it comes to protecting your business, The Hartford general liability insurance stands out as a reliable option that offers comprehensive coverage for a variety of risks. Whether you're a small business owner or running a large corporation, having the right insurance is crucial to safeguarding your assets and ensuring long-term success. With The Hartford's expertise in the insurance industry, you can trust that you're getting a policy tailored to meet your specific needs.

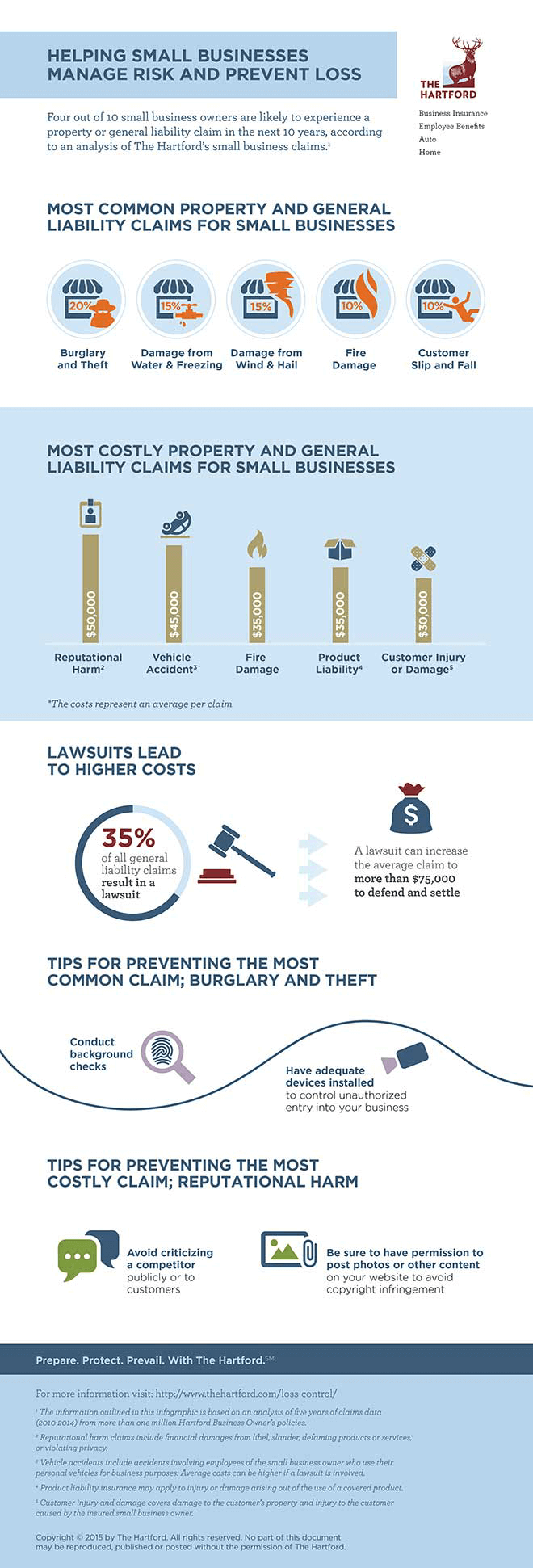

In today's unpredictable world, business owners face numerous challenges that can threaten their operations and financial stability. From lawsuits to property damage, the risks are real and can have devastating consequences if not properly managed. That's where The Hartford general liability insurance comes in. By providing robust coverage options, The Hartford helps businesses protect themselves against unforeseen events, allowing owners to focus on growing their enterprises without worrying about potential liabilities.

What sets The Hartford apart is its commitment to delivering personalized solutions that cater to the unique needs of each business. Whether you're in the retail, construction, or service industry, The Hartford offers flexible policies designed to address the specific risks associated with your line of work. With a reputation for excellence and a network of experienced professionals, The Hartford ensures that you're not just buying insurance but gaining a trusted partner in your business journey.

Read also:Top Tv Shows Featuring The Talented Paty Navidad

Understanding General Liability Insurance

What is General Liability Insurance?

General liability insurance is a type of coverage that protects businesses from claims related to bodily injury, property damage, and advertising injury. It acts as a safety net, ensuring that if someone sues your business, you're not left footing the entire bill. For instance, if a customer slips and falls in your store, this policy could cover the legal fees and any settlements that may arise from the incident.

While it might sound straightforward, general liability insurance is more than just a legal safeguard. It's a strategic investment that can help protect your business's reputation and financial health. By demonstrating that you have the proper coverage, you're showing your clients and partners that you're serious about running a responsible and trustworthy operation.

Why The Hartford Stands Out

The Hartford has been in the insurance business for over 200 years, and its experience shows in the quality of its general liability policies. Unlike some insurers that offer one-size-fits-all solutions, The Hartford takes the time to understand your business and craft a policy that aligns with your specific needs. This personalized approach ensures that you're not paying for coverage you don't need while still getting the protection you do.

Moreover, The Hartford's customer service is top-notch. If you ever have questions or need assistance, their team of experts is just a phone call away. This level of support is invaluable, especially during stressful situations like filing a claim or dealing with a lawsuit.

Key Features of The Hartford General Liability

Comprehensive Coverage Options

One of the standout features of The Hartford general liability insurance is its comprehensive coverage. Here are some of the key areas it protects against:

- Bodily Injury: Covers medical expenses and legal fees if someone is injured on your premises or due to your products or services.

- Property Damage: Provides protection if your business causes damage to someone else's property.

- Advertising Injury: Includes coverage for claims related to libel, slander, copyright infringement, and more.

- Product Liability: Protects against claims that your products caused harm or injury to consumers.

By offering such a wide range of protections, The Hartford ensures that your business is shielded from a variety of potential liabilities.

Read also:Internal Temp Pork Sausage The Ultimate Guide To Perfectly Cooked Sausages

Flexible Policy Structures

Not all businesses are the same, and The Hartford recognizes this by offering flexible policy structures. Whether you're a startup or an established company, you can choose a policy that fits your budget and coverage needs. Some of the customization options include:

- Adjustable coverage limits to match your risk exposure.

- Optional endorsements to add extra layers of protection.

- Customizable deductibles to help manage costs.

This flexibility allows you to tailor your insurance policy to your specific circumstances, ensuring you get the most value for your premium dollars.

How The Hartford General Liability Works

Policy Limits and Deductibles

Understanding policy limits and deductibles is crucial when choosing a general liability policy. The Hartford offers various limits, ranging from $1 million to $5 million or more, depending on your business's size and risk profile. Higher limits provide greater protection but come with higher premiums. Deductibles, on the other hand, determine how much you'll pay out of pocket before the insurance kicks in. The Hartford allows you to adjust these amounts to find the right balance between cost and coverage.

Filing a Claim

Should the unfortunate happen and you need to file a claim, The Hartford makes the process as smooth as possible. Their claims team is available 24/7 and can guide you through each step. Here's a quick overview of what to expect:

- Contact The Hartford immediately to report the incident.

- Provide all necessary documentation, such as police reports or medical records.

- Work with their claims adjusters to assess the damage and determine the payout.

With The Hartford's efficient claims process, you can rest assured that your business will be back on track in no time.

Who Needs The Hartford General Liability?

Small Business Owners

Small business owners often operate on tight budgets, making it even more important to have the right insurance. The Hartford general liability insurance is perfect for startups and small enterprises, offering affordable premiums without compromising on coverage. Whether you run a local bakery or a consulting firm, this policy can help protect your assets and ensure your business's longevity.

Large Corporations

For larger companies, The Hartford's general liability insurance provides the robust protection needed to handle the complexities of running a big operation. With customizable policies and expert support, The Hartford ensures that even the most intricate business structures are adequately covered.

Costs and Savings with The Hartford

Factors Affecting Premiums

The cost of The Hartford general liability insurance varies based on several factors, including:

- Your industry and the associated risks.

- The size of your business and its revenue.

- Your location and local regulations.

- The coverage limits and deductibles you choose.

While the upfront cost might seem significant, the savings come from avoiding costly lawsuits and settlements that could otherwise bankrupt your business. Investing in The Hartford general liability insurance is a smart financial decision that pays off in the long run.

Customer Reviews and Testimonials

What Customers Say

Hearing from real customers can give you a better idea of what to expect from The Hartford general liability insurance. Many business owners praise The Hartford for its reliability, customer service, and comprehensive coverage. Here's what a few satisfied clients have to say:

"The Hartford has been a lifesaver for our business. Their claims process is seamless, and their agents are always available to answer our questions." - Sarah T., Retail Owner

"I was hesitant about purchasing insurance, but The Hartford's personalized approach convinced me. Now, I have peace of mind knowing my business is protected." - John L., Construction Manager

Choosing The Right Policy for Your Business

Assessing Your Needs

Before selecting a general liability policy, it's essential to assess your business's specific needs. Consider the following questions:

- What are the primary risks my business faces?

- What is my risk tolerance, and how much coverage do I need?

- What is my budget for insurance premiums?

By answering these questions, you can work with The Hartford to create a policy that addresses your unique challenges and priorities.

Conclusion: Protect Your Business with The Hartford

The Hartford general liability insurance is more than just a policy; it's a strategic tool that helps safeguard your business's future. With its comprehensive coverage, flexible options, and expert support, The Hartford stands out as a leader in the insurance industry. By choosing The Hartford, you're not only protecting your assets but also demonstrating your commitment to running a responsible and trustworthy business.

So, what are you waiting for? Take the first step toward securing your business's future by contacting The Hartford today. Whether you're a small business owner or a large corporation, The Hartford has a policy tailored just for you. And remember, prevention is always better than cure. Don't let unexpected liabilities derail your business—get the protection you deserve with The Hartford general liability insurance.

Call to Action: Share your thoughts in the comments below or explore other articles on our site to learn more about protecting your business. Together, we can ensure that your enterprise thrives in even the most challenging environments!

Table of Contents

- Understanding General Liability Insurance

- Key Features of The Hartford General Liability

- How The Hartford General Liability Works

- Who Needs The Hartford General Liability?

- Costs and Savings with The Hartford

- Customer Reviews and Testimonials

- Choosing The Right Policy for Your Business

Note: Links are placeholders for navigation within the article.