Running out of checks can be a real headache, especially when you need them for essential payments or transactions. If you're a Chase customer, you're in luck because Chase makes it super easy to reorder checks whenever you need them. Whether you're managing your finances, paying bills, or handling business transactions, having a reliable system for ordering checks is crucial. In this guide, we'll walk you through everything you need to know about Chase reorder checks, step by step.

Let's face it, checks may not be as popular as they used to be, but they're still a vital part of financial management for many people. Whether you're paying rent, sending money to family, or settling large payments, checks offer a secure and reliable way to transfer funds. That's why knowing how to reorder checks from Chase is a skill every customer should have.

Don't worry if you're new to the process or haven't ordered checks in a while. We've got you covered with all the details you need, from the basics to advanced tips. Let's dive right in!

Read also:Boo Williams Sportsplex Your Ultimate Playground For Sports Enthusiasts

Why Chase Reorder Checks Matters

Checks might seem old-school, but they're still an important tool for managing finances. For businesses, landlords, and anyone who prefers paper trails, checks provide a level of security and accountability that digital payments sometimes lack. Chase reorder checks ensures you're always prepared for whatever financial situation comes your way.

Here are some reasons why Chase reorder checks is worth your attention:

- Convenience: Ordering checks online or through the Chase app is fast and hassle-free.

- Security: Chase works with trusted vendors to ensure your checks are printed with top-notch security features.

- Customization: You can personalize your checks with your name, address, and even design preferences.

- Peace of Mind: Never worry about running out of checks again when you have a reliable reorder system in place.

How to Chase Reorder Checks: Step-by-Step Guide

Ordering checks from Chase is simpler than you might think. Follow these steps to get your new checks in no time:

Step 1: Log In to Your Chase Account

Start by accessing your Chase account online or through the Chase mobile app. Make sure you're logged in securely to avoid any issues. If you're not already registered for online banking, now's a great time to sign up!

Step 2: Navigate to the Order Checks Section

Once you're logged in, look for the "Order Checks" option. It's usually found under the "Account Services" or "More" section. Click on it to proceed to the next step.

Step 3: Choose Your Check Design

Chase offers a variety of check designs to suit your personal or business needs. You can select from pre-designed templates or create a custom design if you prefer. Don't forget to double-check all the details before finalizing your order!

Read also:Temporary Replacement 3 Full Hyungry Your Ultimate Guide To Surviving Hunger With Style

Step 4: Verify Your Information

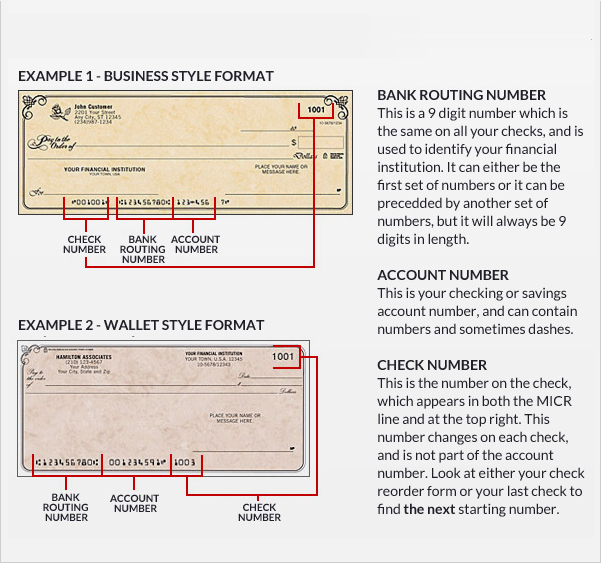

Before submitting your order, make sure all your personal and account information is correct. This includes your name, address, and account number. Accuracy is key to avoiding delays in receiving your new checks.

Step 5: Submit Your Order

Once everything looks good, submit your order. You'll receive a confirmation message or email letting you know your checks are on the way. Delivery times may vary depending on your location and the shipping option you choose.

Common Questions About Chase Reorder Checks

Here are some frequently asked questions about Chase reorder checks:

How Long Does It Take to Receive New Checks?

Typically, it takes about 7-10 business days for your new checks to arrive. Expedited shipping options are available if you need them sooner.

Can I Order Checks for a Joint Account?

Absolutely! Both account holders can order checks for a joint account. Just make sure you're logged in with the correct account credentials when placing the order.

What Happens If My Checks Are Lost or Stolen?

If your checks are lost or stolen, contact Chase immediately to report the issue. They'll help you cancel the old checks and issue new ones to keep your account secure.

Top Tips for Managing Your Chase Checks

Here are some pro tips to help you manage your Chase checks more effectively:

- Keep track of how many checks you have left to avoid running out unexpectedly.

- Store your checks in a secure location to prevent unauthorized access.

- Regularly review your checkbook register to ensure all transactions are accurate.

- Consider setting up automatic reorder reminders to stay ahead of the game.

Understanding the Costs of Chase Reorder Checks

One of the most common concerns about ordering checks is the cost. Chase doesn't charge a direct fee for ordering checks, but the vendor they partner with may charge a processing fee. Prices can vary depending on the type and quantity of checks you order. Basic checks usually start around $15-$20, while premium designs can cost more.

Here's a breakdown of typical check ordering costs:

- Basic Checks: $15-$20

- Premium Checks: $25-$40

- Business Checks: $30-$50

Security Features of Chase Checks

Chase takes security seriously, and their checks come equipped with advanced features to protect against fraud:

- Watermark: A unique watermark is embedded in the paper for easy verification.

- Security Ink: The ink changes color when viewed from different angles to prevent counterfeiting.

- Microprinting: Tiny text is printed on the checks to make them harder to forge.

- Chemical Protection: The paper reacts to certain chemicals to prevent tampering.

Chase Reorder Checks vs. Other Banks

When it comes to ordering checks, Chase stacks up well against other major banks. Here's how Chase compares:

Chase

Pros: Easy-to-use online ordering system, wide range of design options, strong security features.

Bank of America

Pros: Similar ordering process, competitive pricing, reliable delivery times.

Wells Fargo

Pros: Good customer service, multiple vendor options, customizable designs.

Ultimately, the choice comes down to personal preference and specific needs. Chase offers a seamless experience that many customers appreciate.

Best Practices for Using Chase Checks

Using checks effectively requires a bit of strategy. Here are some best practices to keep in mind:

- Always write checks in ink to prevent alterations.

- Use a checkbook register to track your transactions and balances.

- Double-check all information before signing a check to avoid errors.

- Shred old checks before disposing of them to protect sensitive information.

Conclusion: Stay Prepared with Chase Reorder Checks

Chase reorder checks is a straightforward and reliable way to ensure you're always ready for any financial situation. Whether you're managing personal or business finances, having a steady supply of checks is essential. By following the steps outlined in this guide, you can reorder checks with confidence and ease.

Don't forget to share this guide with friends or family who might find it helpful. And if you have any questions or feedback, feel free to leave a comment below. Let's keep the conversation going and help each other stay on top of our financial game!

Table of Contents

- Why Chase Reorder Checks Matters

- How to Chase Reorder Checks: Step-by-Step Guide

- Common Questions About Chase Reorder Checks

- Top Tips for Managing Your Chase Checks

- Understanding the Costs of Chase Reorder Checks

- Security Features of Chase Checks

- Chase Reorder Checks vs. Other Banks

- Best Practices for Using Chase Checks

Thanks for reading, and remember to always stay ahead of the game with Chase reorder checks!